CryptoSuper500, 2nd Edition

What is new with the most powerful crypto mining pools?

Thanks to the efforts of my colleague Dr. Stephen Perrenod, OrionX launched a new CryptoSuper500 list last November, coinciding with the eagerly awaited TOP500 list of most powerful supercomputers. The TOP500 has spawned variations that look at different workloads and attributes, for example, the Green500, Graph500, and IO500 lists. CryptoSuper500 was inspired by those lists.

Please see the material for the inaugural edition of the CryptoSuper500 list here and here. As you can see from what we can share publicly, we track business, technology, and policy issues surrounding emerging technologies and take a realistic approach to what they can do, and under what circumstances their use is a wise choice. Blockchain and cryptocurrencies are very much in that mix as are IoT, Quantum Computing, 5G, and Cloud.

Cryptocurrency mining operations are often pooled and are very much supercomputing class, typically using accelerator technologies such as custom ASICs, FPGAs, or GPUs. Bitcoin is the most notable of such currencies. Scroll down for the top-10 list and see the slides for the full list and the methodology. Contact us if you’d like discuss it in person.

We issued the following press release to formally announce this 2nd edition. Read it below or here.

Bitcoin and BTC.com in China Continue to Top the Second Edition of CryptoSuper500 List

Inspired by the TOP500 list, biannual list of the most powerful cryptocurrency mining pools tracks compute power and economic value

MENLO PARK, Calif. – June 14, 2019 – OrionX Research today released the second edition of its CryptoSuper500 list. The list recognizes cryptocurrency mining as a new form of supercomputing and tracks the top mining pools. Cryptocurrency technologies include blockchains, consensus algorithms, digital wallets, and utility and security tokens. Aided by a recent surge in cryptocurrency prices, the top 10 mined coins have market caps above $0.5 billion dollars, and the #1 coin, Bitcoin, as of our snapshot taken on May 30, 2019, had a market cap of $154 billion.

Cryptocurrency Supercomputing refers to large-scale cryptocurrency mining operations which are typically powered by accelerator technologies such as GPUs, FPGAs, or custom ASICs. Bitcoin is the most notable of such currencies. Cryptocurrency mining via Proof of Work is important since it continues to represent the most effective consensus algorithm to maximize security in a decentralized manner.

“Driven by Artificial Intelligence (AI), Blockchain, Internet of Things (IoT), and 5G connectivity, a new wave of enterprise applications demands supercomputing power. Cryptocurrency mining is an important part of that mix, impacting investment decisions globally,” said Dr. Stephen Perrenod, OrionX Partner and Analyst and the developer of the CryptoSuper500. “CryptoSuper500 tracks supercomputer class systems that are used for such mining applications.”

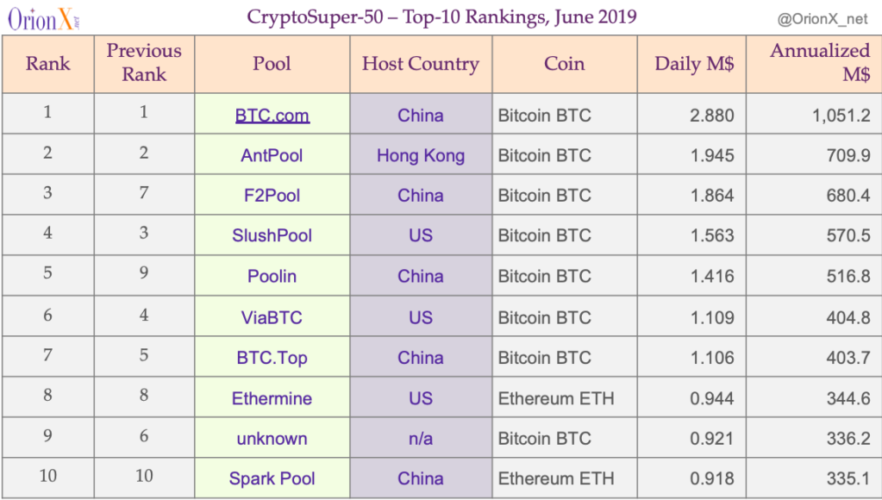

The annual economic value (AEV) of the top 5 pools in the current list compared to the last list (published in November 2018) are as follows:

- BTC.com in China with projected AEV of $1.05 billion compared to $694 million in November 2018

- Antpool based in Hong Kong with an AEV of $710 million compared to $582 million

- F2Pool in China with an AEV of $680 million compared to $368 million

- SlushPool in the US with an AEV of $571 million compared to $444 million

- Poolin in China with an AEV of $517 million compared to $289 million

ViaBTC in the US and BTC.Top in China were among the top 5 in the previous list and have been edged out by F2Pool and Poolin in the current list.

The eight coins mined with Proof of Work consensus algorithms and that made the cut for our analysis are Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Zcash, Bitcoin SV, Dash and Monero. All except Monero require ASICs for efficient mining. Only Bitcoin and Ethereum mining pools are found in the current top 10.

The full list with additional explanation is available in a slide presentation at OrionX.net/research.

“The traditional data center is becoming a supercomputer center,” said Shahin Khan, OrionX Partner and Analyst. “Corporate IT departments increasingly rely on versatile supercomputers as the engines of digital transformation. Green500, IO500, CryptoSuper500 and similar competitive lists point to the versatility of supercomputers and the need for supercomputing in Fortune 500.”

About OrionX

OrionX is a Silicon Valley firm with a new model that combines technology research, market execution, and customer engagement. More than 60 technology leaders in virtually every technology segment have trusted OrionX to help set new break-away strategies, ignite brands, and grow market share. Visit us at OrionX.net.

* Note: This effort is an analysis of the technologies and trends surrounding blockchain and cryptocurrencies. It is not, and must not be considered as, financial, investment, or legal advice.

References:

Overall: coinmarketcap.com, coinwarz.com, cryptoslate.com

BTC: btc.com

ETH: etherscan.io, btc.com

BCH: btc.com, cash.coin.dance

LTC, ZEC, XMR, DASH: miningpoolstats.stream

Cryptocurrency topics: orionx.net/blog

Shahin is a technology analyst and an active CxO, board member, and advisor. He serves on the board of directors of Wizmo (SaaS) and Massively Parallel Technologies (code modernization) and is an advisor to CollabWorks (future of work). He is co-host of the @HPCpodcast, Mktg_Podcast, and OrionX Download podcast.