Bitcoin: A New Asset Class

A new asset class has been born. Sift through the posts on your social media and you will find that just a few years ago, it was big news that Bitcoin had broken $1000. That was a big deal because it was the third time Bitcoin was priced more than $1k. Digital money was starting to look like a major new trend in information technology. But Bitcoin observers were used to volatility and it was going to take more than a few ups and downs to convince them.

Back in 2011, when it had topped $30, that too was seen by many as proof that it was “happening”, but it had gone back down, way down, to $2 by that December. But then it rose again, and in 2013 rallied all the way to $266. And back down to $70, only to climb to $1200 that November. And then down again and up again in 2014. No, not for the faint of heart.

It wasn’t just price volatility. The buying and selling process was too hard, it was not clear what was or wasn’t legal, and there were too many technical issues and scams. Some exchanges lost people’s money. In other cases, people forgot their passwords and their Bitcoins became permanently inaccessible. The coins were there but were untouchable. And so it’s been: a roller coaster ride with many setbacks.

You can’t learn about Bitcoin w/o learning the word “hodl”. Presumably, someone under the influence of some kind of libation, had posted an email in a forum with the subject “I am hodling”, misspelling the word “holding”. And so the crypto world has its legion of “hodlers” who allegedly never sell, expect, we must assume, when they do sell!

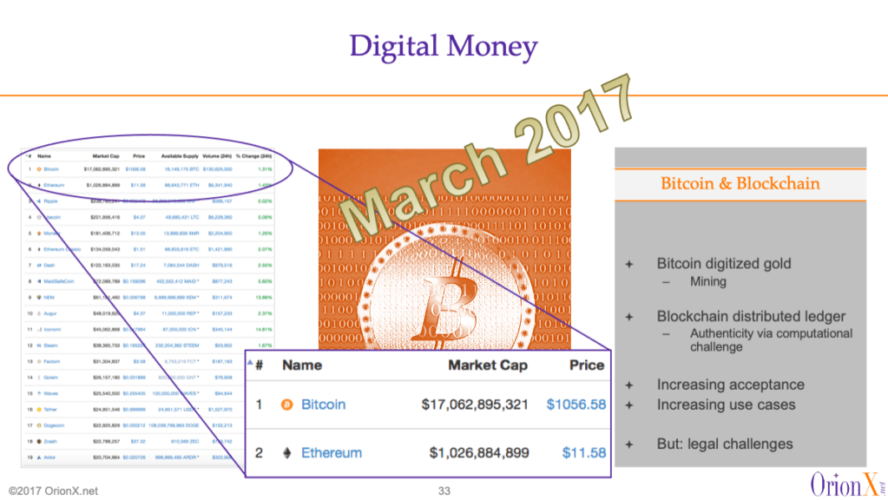

Between Feb 2014 and Dec 2016, it stayed in the $200-$800 range. But when it crossed $1000 a third time in Jan 2017, went back down but rose again to set a new high of $1.3k in March of 2017, well, it was starting to look pretty resilient. To some, it indicted that it was now the real deal, to some others, shaking their heads, it was tulip bulbs all over again.

It never went back below $1k. Through 2017, its price moved up and fast, thanks to exchanges that made it easy to buy it, favorable legal rulings that seemed to let it go forward some more, and more publicity that made it interesting. By Dec 2017, it had shot up to $18k. That’s for one single Bitcoin, which back in 2010 was worth 0.0025 cents. Someone had actually 10,000 Bitcoins to pay for pizza. $25. By that July, however, it was up to 8 full cents. Regretting the pizza purchase had come quickly, but it’s all relative.

But then it crashed and while going up and down, it eventually went all the way down to about $3400 in Feb 2019. Some took that as lessons learned, others thought it was time to buy more if they had the money. Then it started a slow climb, and every time the traditional financial markets showed instability or pushed things this way or that way, or some financial institution offered some kind of support, or some company made a big deal of investing in it, Bitcoin became a bit more competitive. Then Facebook talked up its own cryptocurrency plans and central banks hurried up to claim the space, and interest in crypto started building again.

Now as we approach the end of the year, a new phase for Bitcoin is starting. Places like Paypal have made it easy for their large and existing customers to buy Bitcoin, the stock market has done very well with profits to be taken and portfolios to be re-balanced, a new administration is coming, and major players are making visible and large bets on Bitcoin.

So once again, there is new demand, ease of acquisition, and a favorable environment, so Bitcoin price has shot up, past the $20k resistance and it is over $27k as of this writing.

All of that means another turn of the Bitcoin acceptance knob. Bitcoin is looking like the new asset class that a lot of people said it was. It has been volatile and may remain so, going up or down again as those who bought earlier do some profit taking and new arrivals hesitate. But a new asset class has been born.

Note: As usual, this is not investment or legal advice. Or any kind of advice. Walks down Wall Street are always random!

Shahin is a technology analyst and an active CxO, board member, and advisor. He serves on the board of directors of Wizmo (SaaS) and Massively Parallel Technologies (code modernization) and is an advisor to CollabWorks (future of work). He is co-host of the @HPCpodcast, Mktg_Podcast, and OrionX Download podcast.