Growing in the Asia-Pacific Marketplace

We are all aware that China and India are the two most populous nations on the planet, and that their economies boast impressive growth rates in the range of 8 to 10% per year. In the Asia-Pacific (APAC) region these two nations alone have about 2/3 of the area’s population. Most of us are also aware that China has just recently surpassed Japan to become the world’s second largest economy.

As we seek to grow our business in this most dynamic region of the world, what strategy should we pursue? A Go Big strategy might argue that we should focus on the two largest nations, and look to reap rewards primarily in those two. An alternative strategy, which we dub Go Smart, would look at issues beyond the population size and the size of the economies concerned. One way to refine our strategy is to understand the propensity of the major countries in the region to import high technology from US or other Western suppliers.

With a Go Smart strategy we might look first to focus on more developed markets, where foreign companies have the opportunity to obtain higher operating margins and where the receptivity to, and experience of, importing US technology are greater. These developed countries within APAC spend proportionately more of their GDP on imports from the US and Europe. Also, a number of these countries are not just markets in and of themselves, they are also gateways to doing business in China, India, and in Southeast Asia for cultural and historic reasons.

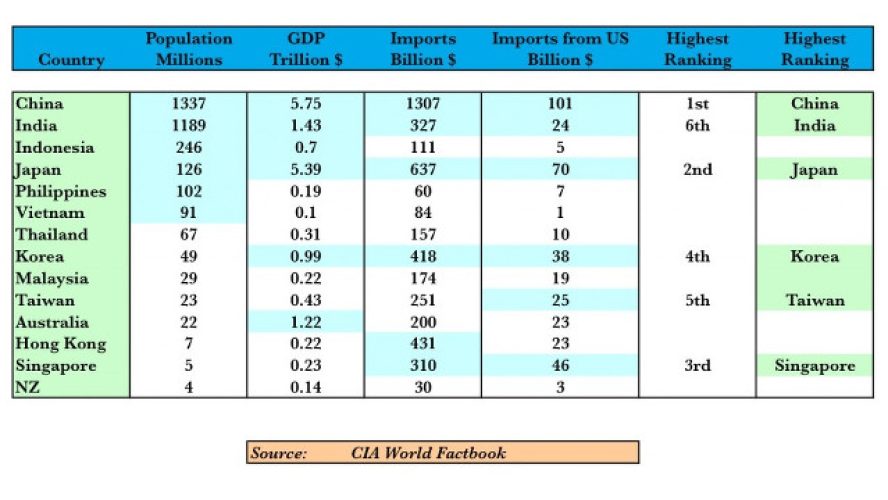

Let’s look at some statistics in Table 1 below for 14 of the most important countries in APAC. By population the 6 largest countries are China, India, Indonesia, Japan, the Philippines and Vietnam. Only one of these (Japan) is considered a developed country today; the others are in the developing category. By GDP the rank order for the top 6 is China, Japan, India, Australia, Korea (South) and Indonesia.

Table 1: APAC Population, GDP, and Import Statistics

But is GDP the most relevant statistic, or is it more insightful for an IT technology supplier to look at import numbers? For imports the ranking becomes China, Japan, India, Korea, Hong Kong and Singapore. And, if we further refine our analysis to look at imports from the US, the top 6 are China, Japan, Singapore, Korea, Taiwan and then India – a quite different ordering from both the population ranking and the GDP rank ordering. North Asia (China, Japan, Korea, Taiwan) generally dominates in imports from the US, but Singapore, the gateway to Southeast Asia, is found at number 3, well ahead of India.

Orion Marketing would be pleased to work with you to assist in your development of an insightful, Go Smart, business strategy as you seek to enter the Asia-Pacific market or successfully grow your existing business in the APAC theater. In part two of this three part blog series, we will look at some personal experiences in the Asia-Pacific marketplace.

Stephen Perrenod has lived and worked in Asia, the US, and Europe and possesses business experience across all major geographies in the Asia-Pacific region. He specializes in corporate strategy for market expansion, and cryptocurrency/blockchain on a deep foundation of high performance computing (HPC), cloud computing and big data. He is a prolific blogger and author of a book on cosmology.